modified business tax refund

Commerce Tax Credit Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

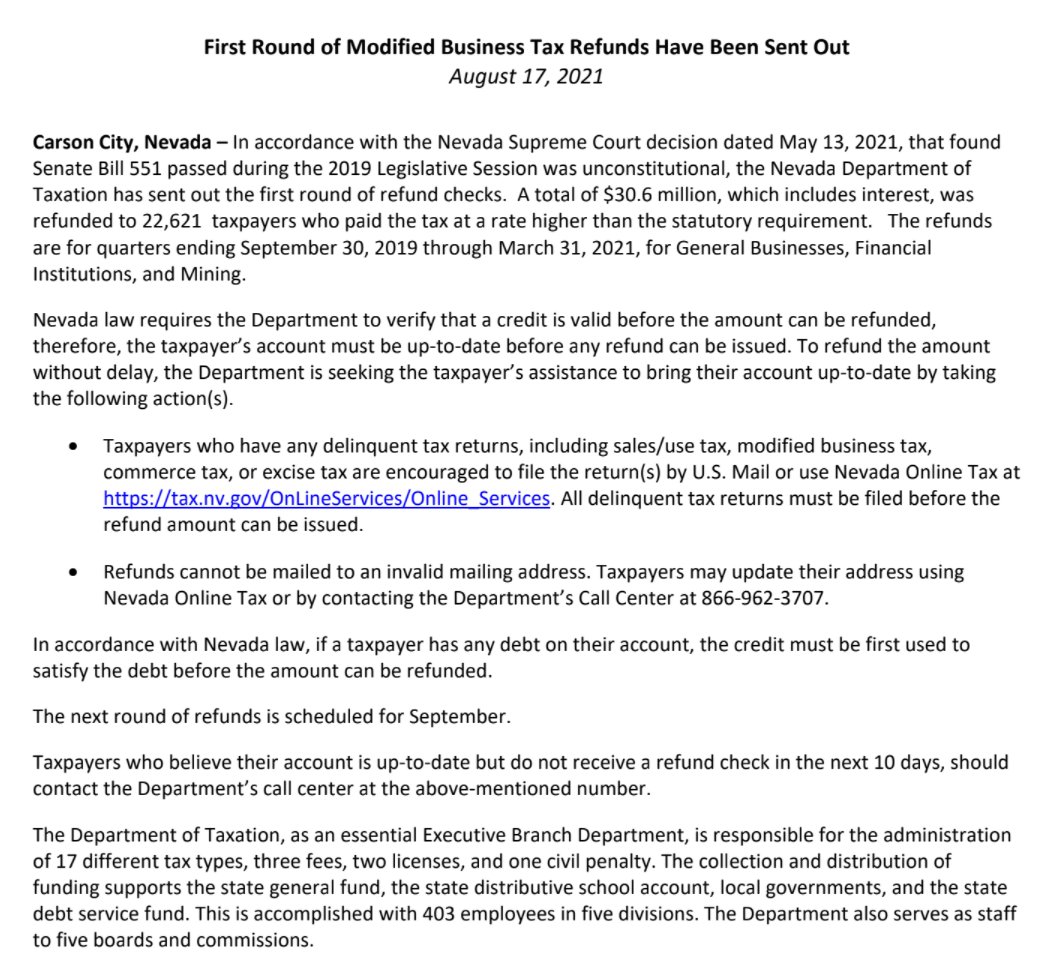

1st round of modified business tax refunds sent to businesses in Nevada.

. Accurate affordable and time-saving. How you can complete the Nevada modified business tax return. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

Modified business tax refund. Fill out Modified Business Tax Return General Businesses Form within a few minutes following the recommendations listed below. And ordered the Department of Taxation to refund any overpayment of the Modified Business Tax plus interest.

Do not enter an amount less than zero. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and. This is an optional tax refund-related loan from MetaBank NA.

If the credit amount is higher. The Nevada Department of Taxation has sent out the first round of refund checks to businesses. The next round of refunds is scheduled for September.

Approval and loan amount. Use this step-by-step guide to complete the Nevada modified business tax return form promptly and with excellent precision. Ad Spend less time worrying about taxes and more time running your business.

If the credit amount is higher. Let us do the work for you. Loans are offered in amounts of 250 500 750 1250 or 3500.

It is not your tax refund. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada. We recommend that you obtain a.

Understanding Your Tax Forms 2016 1099 K Payment. Pick the document template you need from the collection. BUSINESS TAX GENERAL BUSINESS.

Friday March 18 2022. Selfemployedproduct Tax Forms Job Info Self Assessment. Total gross wages are the total amount of all gross wages and reported tips paid.

Line 10Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. In all likelihood the Modified Business Tax Return Form is not the only document you should review as you seek business license compliance in.

The Department is developing a plan to reduce the. According to media reports the legal dispute over Senate Bill 551 emerged when the Democrat-led Senate passed. But Congress has made up to 10200 of unemployment benefits nontaxable for the 2020 tax year for those with modified adjusted gross incomes of less than 150000.

Ad Taxes Can Be Complex. Credits - Enter amount of overpayment of Modified Business Tax made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not enter an amount less than zero.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Let TurboTax Find Every Deduction To Maximize Your Refund.

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages. Modified Business Tax has two classifications.

Blayne Osborn Blayneosborn Twitter

Uk Prepare Your Vat Return Help Center

Accrual Accounting Concepts Examples For Business Netsuite

James Settelmeyer Settelmeyernv Twitter

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

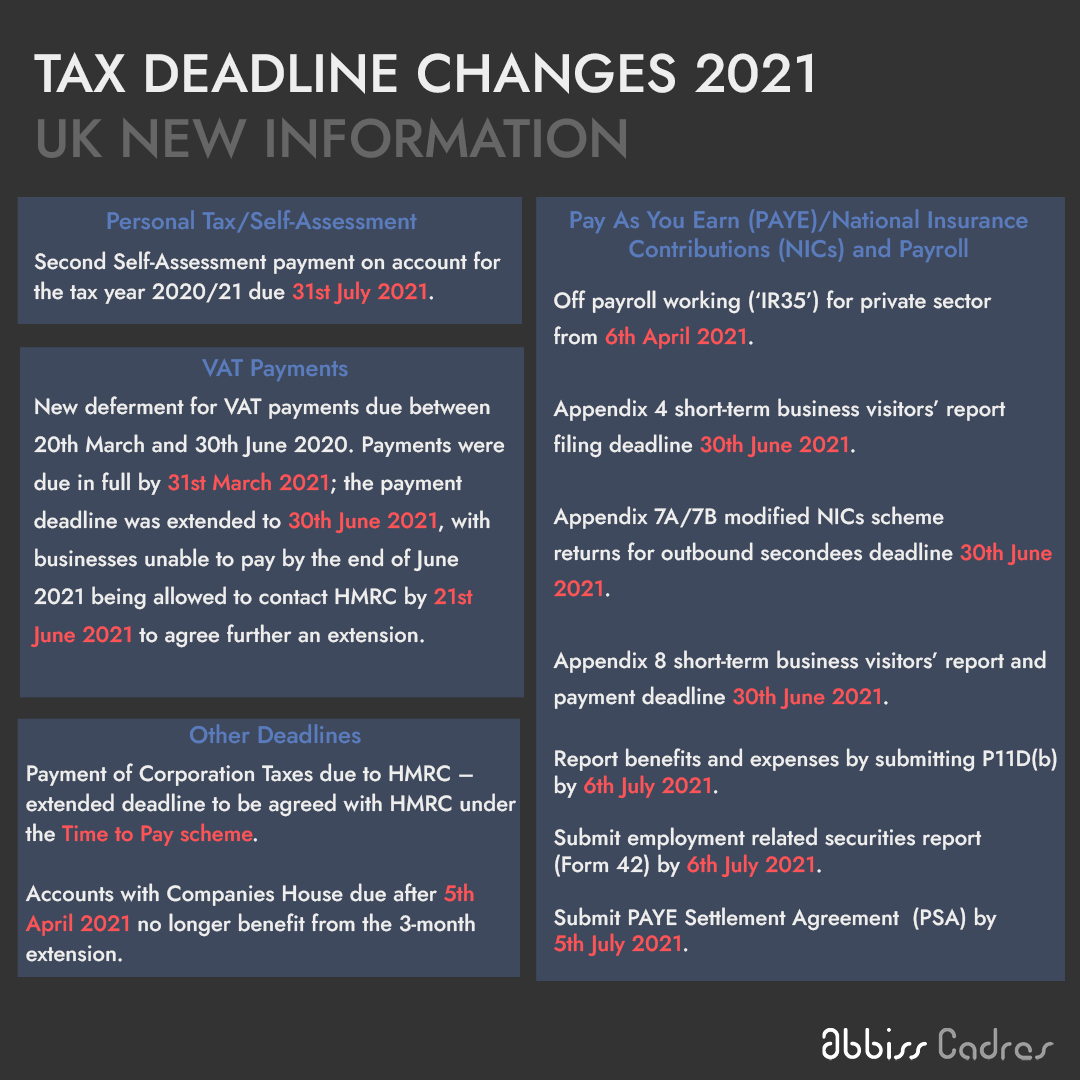

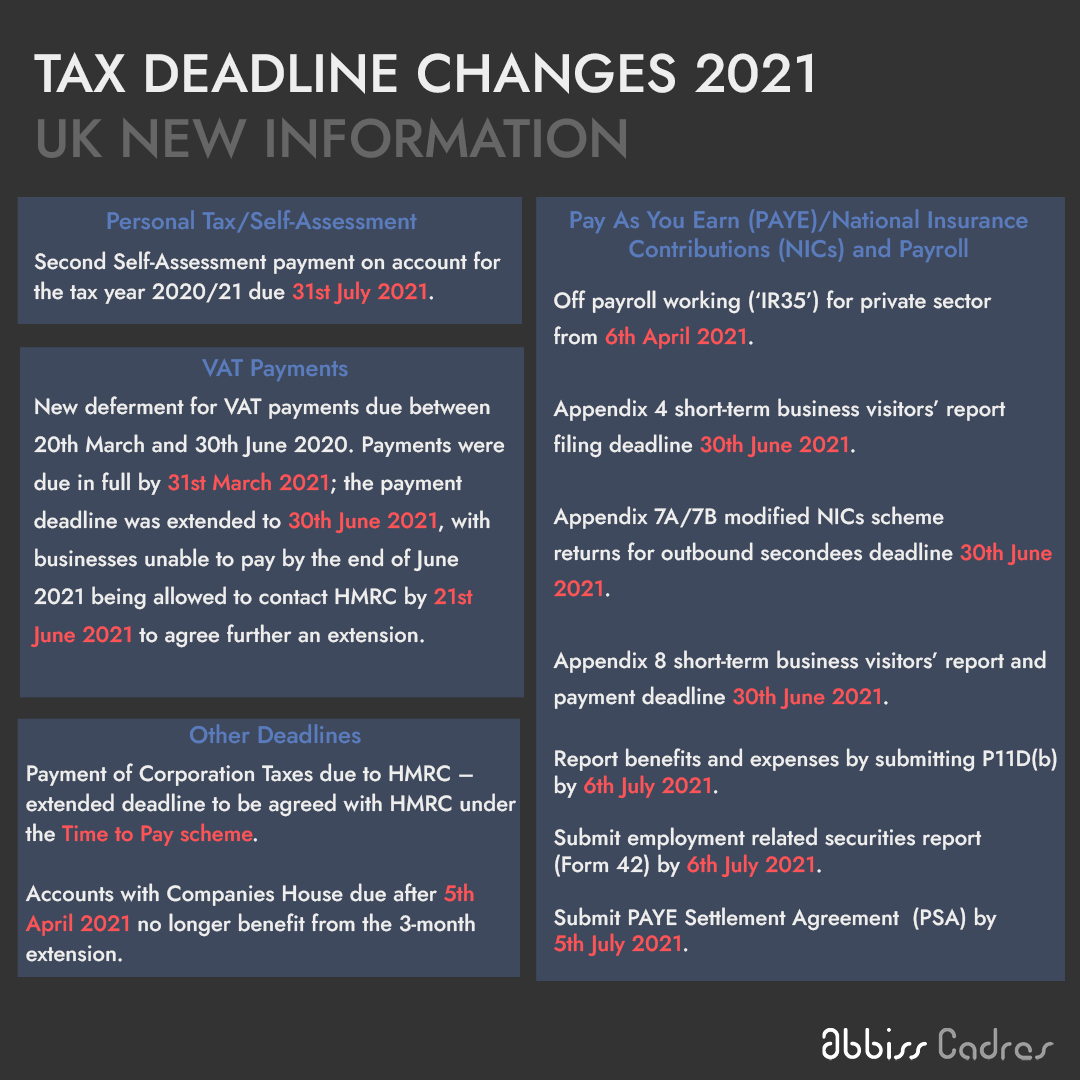

Hmrc 2021 Uk Tax Deadline Changes Amid Covid 19 Abbiss Cadres

Hmrc Invoice Requirements In The Uk Tide Business

How Is Tax Collected On Taxable State Benefits Low Incomes Tax Reform Group

We Make You A Fake Tax Return Document For 2017 Or Earlier Year Great Proof Of Annual Income For Application Purp Tax Return Income Tax Return Irs Tax Forms

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)